Access Bank Can’t Trace N200,000 Taken From Customer’s Account

After going back and forth with Access Bank for more than a week in search of responses to how N200,000 disappeared from his account, Save Otubu, a Delta-based man, received a message from the bank empathising with him on the loss of his funds and also informing him there was nothing they could do to recover it.

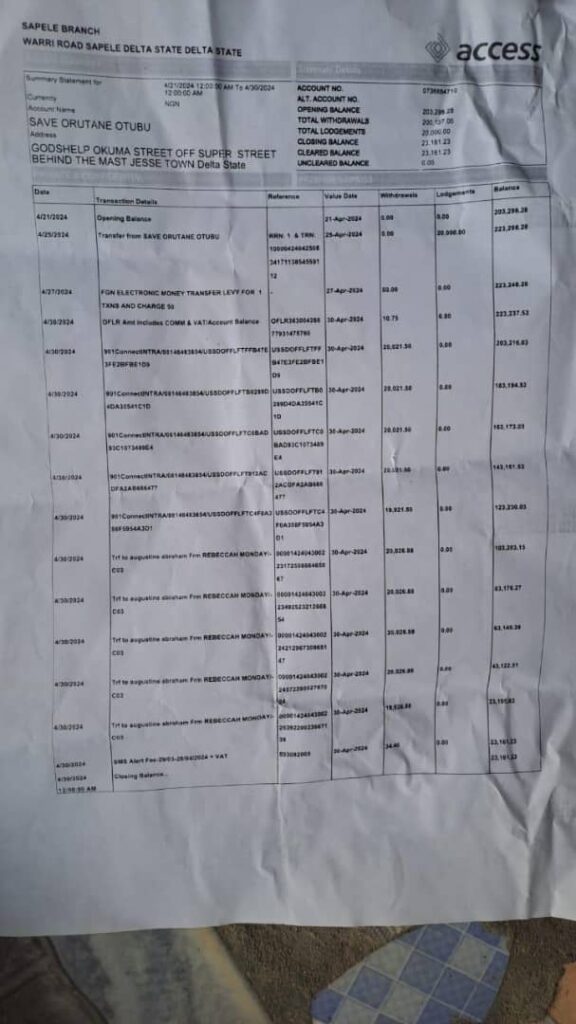

Before going to bed on April 29, Otubu had N223,000 in his account but woke up to 10 debit alerts from Access Bank and less than N23,000 in his account the following day.

He wondered how it had happened.

“I had my phone with me, and I stayed alone. So, there was no way someone could have initiated the transaction on it. My ATM card was not linked to the account, and I did not click on any (malicious) link. The transactions were done between 2:18 am and 2:25 am,” he said.

That morning, he went to an Access Branch branch in Sapele, Delta State, to lodge complaints. When he arrived, a customer care representative there told him they had no network and asked him to wait.

He told FIJ that the representative also said the bank had received several similar complaints and asked him to check back on May 2 for further directives. He obliged, but when he returned on May 2, the bank’s manager told him he had fallen victim to “bad boys”.

“He asked if I had friends who did fraud, and I said no. He said the transfers were done via USSD. So, I asked how that was possible because I had my phone then. He said I had fallen victim to bad boys. I asked him to provide the account the funds were transferred into, and he said it was not on record.

“I was surprised that money could leave someone’s account and the bank would not have any information on the beneficiary’s account.”

The bank’s manager also told him to write to Access Bank’s anti-fraud unit so they could help him trace where the money went. Otubu also told FIJ that the bank’s manager told him the chances of recovering his money were slim.

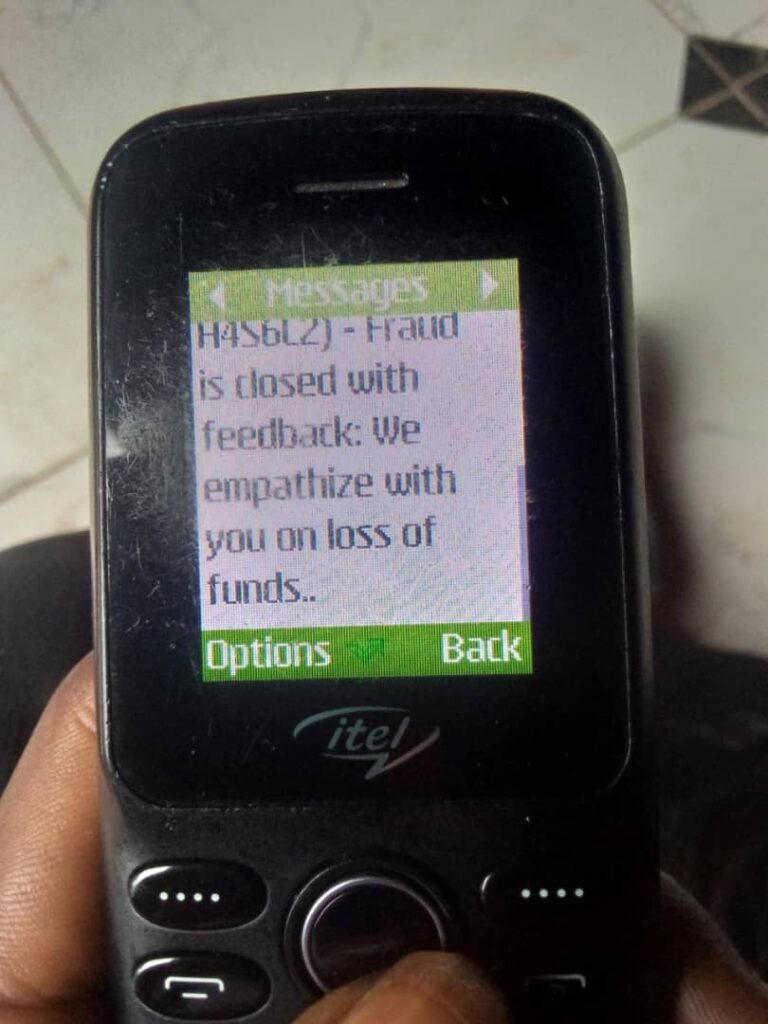

On May 3, he received a message from Access Bank that read: “Fraud is closed: We empathize with you on the loss of funds.”

Again, on May 9, he returned to the bank to get clarifications on the message he received.

“The customer care representatives said their anti-fraud unit at the bank’s headquarters only empathised with me on the loss of funds, and there was nothing they could do. I met with the bank manager, and he said the same thing,” Otubu told FIJ.

When FIJ emailed Access Bank on Thursday, they promised to respond within 24 hours, but there was no word from them at press time.

No comments