UBA Can’t Account for Strange N2.27m Debit From Nigerian Student’s Account

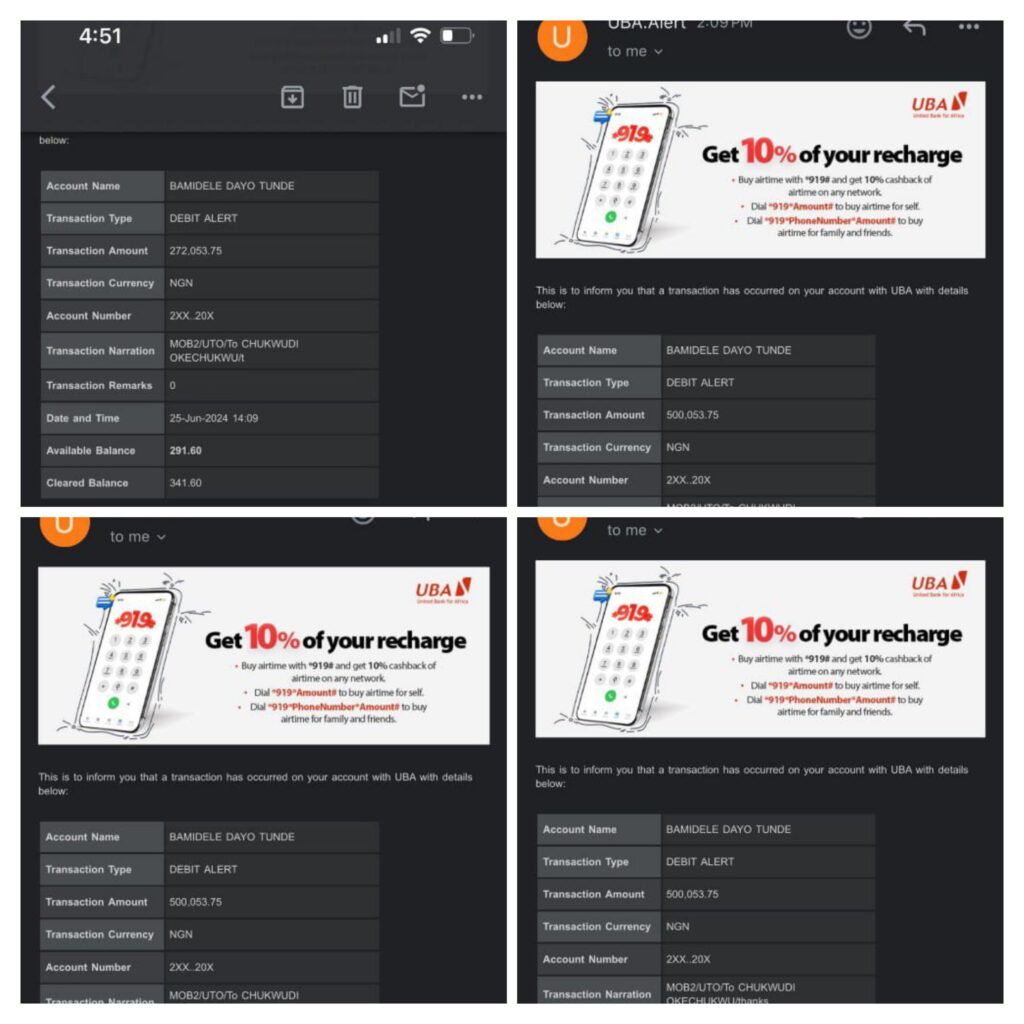

On June 25, Bamidele Dayo, a Nigerian student in the United Kingdom, transferred N10,000 from his United Bank for Africa (UBA) account. One minute later, he got a series of strange debit alerts on his phone: N500,000 in four places and an extra N272,000!

That was how Dayo lost N2.272 million. But when he contacted UBA, their forensic investigation did not show how his money got stolen.

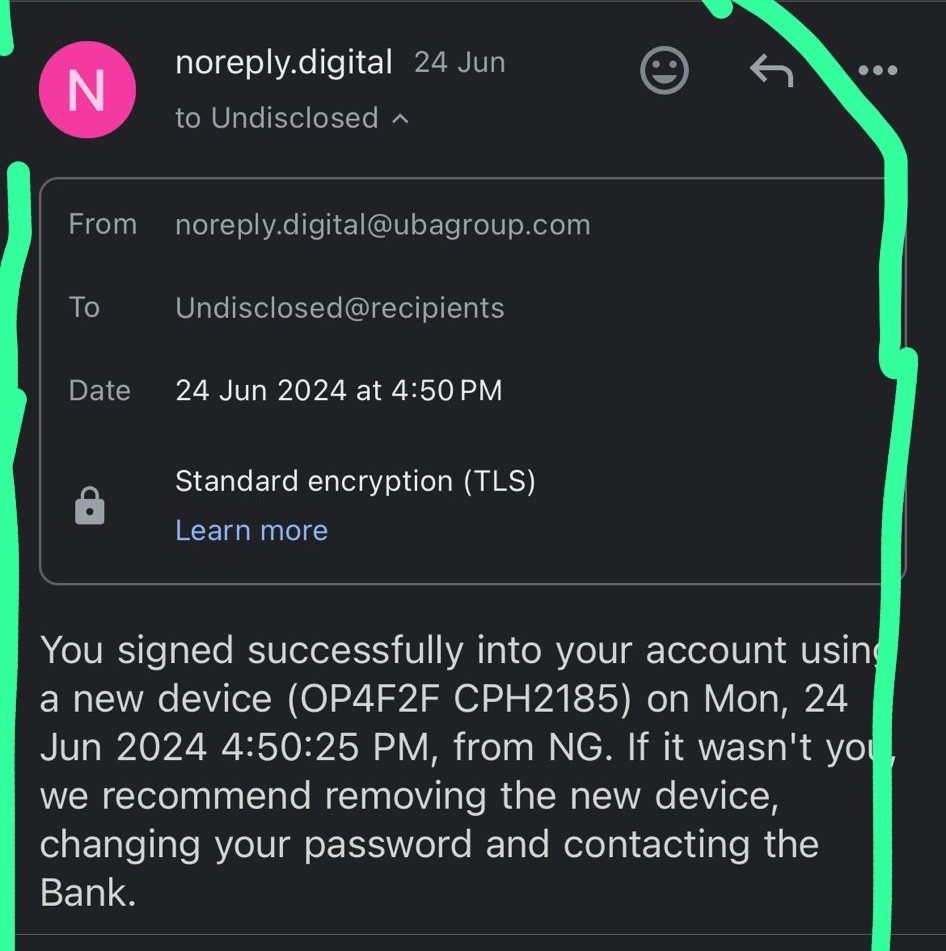

Dayo, who is studying to get a master’s degree, told FIJ that he got an email notification that another phone had been attached to his UBA app. He found this rather shocking as he had not handed his phone or account details to a third party.

“I could log in, yet someone somewhere in Nigeria could still log in on the same mobile app. I wondered how two mobile devices could be attached to one account without me getting an OTP (one-time password),” Dayo told FIJ on Saturday.

He also explained that the debit was done through a mobile transfer by the same account that was attached to his account.

Dayo also told FIJ that he called UBA’s fraud help desk immediately and they told him they would swing into action. He said that the fraud desk told him they would have to lock his account for a forensic investigation to settle the dispute.

“UBA came up with a forensic report, showing clearly that the app that was used to move that money was excluded from their forensic investigation, which means they could not trace the app that was newly attached to the account that was used to move the money,” Dayo explained.

In the forensic report by UBA, the bank documented that the disputed transaction had been “carried out using his log-in details, and

validated with sensitive authentication data” known to Dayo alone.

“A review of our UBA Mobile Banking enrolment log confirmed that your account was created on the platform on May 31, 2023, another device was added on September 21, 2023, and March 28, 2024, using your valid account credentials and a verification code which was used to

successfully complete/activate the enrolment process was delivered to

your mobile number…,” another section of the forensic reads.

Dayo explained to FIJ that he once went to a UBA branch in Ikorodu to rectify a bank issue on September 21, while March 21 was the day he changed to a new device in the UK. He also said he had retained possession of his old phone since then.

“Those are the verified devices that were attached to my account, and for them, an OTP was sent to my account, but the one that was used to move my money, there was no OTP sent to me and UBA did not include it in their forensic report,” Dayo told FIJ.

“The money was sent to a Moniepoint account.”

Dayo also said that the loss had affected his fee payment and he had to take a loan to pay his tuition.

He told FIJ that, suspecting foul play, he employed the services of a lawyer. But when his lawyer reached out to UBA via a letter, the bank responded that it would conduct a fresh investigation on July 1.

“We did not get any reply from them till the end of July. So, I told the lawyer to write a reminder note which he sent to them on August 8,” Dayo told FIJ on Saturday.

“UBA now handed a letter that should have got to the lawyer on the 18th of July, but they didn’t send it to him until August 8 when he went to give them the reminder. But what they sent to the lawyer was exactly the same thing as the first forensic report they had sent to me earlier.”

FIJ reached out to UBA via an email on Tuesday but the bank asked FIJ to liaise with the affected customer before the issue could be addressed.

“Kindly liaise with our customer to contact us for further assistance,” UBA’s response read.

No comments